The recent Texas legislation session ended with modifications to the Texas Enterprise Zone Program (EZP) and a replacement for the prior Chapter 313 Value Limitation Program.

After recently losing a large semiconductor project to another state, state legislators announced they’d revamp economic development programs.

These economic development modifications were approved by the House and Senate and signed by the governor. Below is an overview of each program.

Enterprise Zone Program

The Texas EZP offers a state-level sales and use tax refund, with the maximum allowable refund based on the company’s planned capital investment and job creation or retention at the qualified business site.

A company may receive these refunds annually over a five-year period. To qualify for these refunds, a company must submit a job certification to the Texas Comptroller’s Office to certify employees.

Under the previous rules, a qualified employee was a person who:

- Worked for a qualified business as defined in Section 2303.402 of the EZP statute

- Received wages from a qualified business from which employment taxes are deducted

- Performed at least 50% of their service for the business at the qualified business site

- If engaged in the transportation of goods and services, reported to the qualified business site and resided within 50 miles of the qualified business site

Prior to the COVID-19 pandemic, companies were able to meet these requirements and receive benefits through the EZP. During the pandemic, many companies transitioned to remote work environments.

Since the pandemic, many companies implemented permanent hybrid or remote work schedules, allowing employees to work a portion of their time off-site. Under the prior statute, these companies would no longer meet the qualified employee requirements for the EZP program.

During the recent legislative session, House Bill (HB) 1515, which was signed into law by the governor on June 12, 2023, expands the definition of qualified employee to the following:

- A resident of the state

- Works for a qualified business

- Receives wages from a qualified business from which employment taxes are deducted

Additionally, a qualified employee must now meet one of the following qualifications:

- Performs at least 50% of their service for the business at the qualified business site

- If the employee engages in the transportation of goods and services, they must report to the qualified business site and reside within 50 miles of the qualified business site

- If the employee engages in services off-site, they must be assigned to the qualified business site and reside within 25 miles of the qualified business site

A second change to the EZP program modifies the initial application process, allowing a certified copy of the ordinance and meeting minutes of all public hearings conducted with respect to the EZP to be submitted as a digital scan of a certified copy. Originally, these documents were required with original signatures.

These changes to the EZP may allow companies who qualified before the pandemic to qualify in a post COVID-19 work environment once again. Learn more with a detailed overview of the EZP program.

Texas Jobs, Energy, Technology, and Innovation Act

Texas lawmakers enacted HB 5, the Texas Jobs, Energy, Technology, and Innovation Act, to replace an outdated economic development program known as Chapter 313.

Chapter 313 intended to attract renewable energy and manufacturing projects with property tax abatements, and officially ended on December 31, 2022.

The most notable changes in the Innovation Act are the exclusion of renewable energy projects and inclusion of infrastructure companies. One other significant change is that school districts are no longer able to negotiate supplemental payments from companies seeking incentive agreements.

Potential Benefits

The Innovation Act allows qualifying companies to receive an abatement on maintenance and operations ad valorem tax of up to 75% for 10 consecutive tax years depending on the project location.

Eligibility Requirements

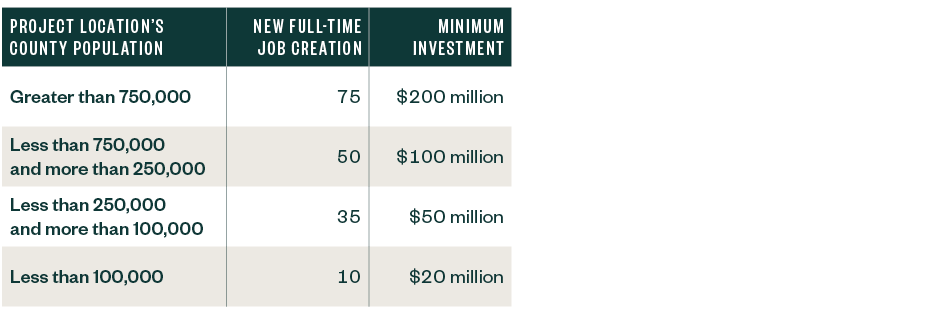

The Innovation Act includes the following jobs and investment requirements for companies to qualify.

How to Apply for Program Benefits

Companies wishing to participate in the new program will complete an application and supporting documents and submit them along with an application fee to the Texas Comptroller’s Office for review. Upon receipt of the application, the comptroller will review and choose whether to recommend the application for approval.

Similar to Chapter 313, the comptroller has 60 days after the date they determine an application is complete to act and provide written notice to the governor, school district, and the applicant.

The governor has 30 days after receiving the application from the comptroller to consider the application and take official action on a potential agreement. The governor will provide written notice of their determination to the comptroller, school district, oversight committee, and applicant no later than the seventh day after making the determination.

The school district has 30 days after they receive an application sent by the comptroller to consider the application and hold a public hearing for comments. The school district will provide written notice of their determination to the comptroller, governor, and applicant.

If approved, the company will enter into an agreement with the governor’s office and school district.

We’re Here to Help

For guidance on whether your company is eligible for these tax credits and incentives, or guidance on claiming program benefits, contact your Moss Adams professional.